Create more deals from your client database

Ownwell keeps you top of mind with automated homeownership reports clients love — and surfaces refinance, renewal, and move-up opportunities worth acting on.

Tired of missing mortgages?

Stay top of mind with personalized, relevant and consistent marketing. Clients are addicted to their homeownership reports, with 66%+ open rates.

You’re in good company ✌️

James Loewen

Loewen Group Mortgages

Since launching Ownwell in August 2024, I’ve been blown away by the results. I started with a relatively small database — just 175 clients who had purchased in the last five years. Fast forward to today, and we’ve already completed 13 refinances/transfers and 7 sell-and-buy transactions with those same clients.

Jeff McGinn

Indi Mortgage

Christian Amurao

Open Doors Mortgage Team

How It Works

Broker imports client data

Ownwell pulls real estate + mortgage rate data and generates insights

Reports are automatically sent to clients, creating engagement on auto-pilot

Clients engage and conversations lead to new deals

Birthday cards and renewal reminders no longer cut it. Give your clients something they’ll value.

See how Ownwell drives repeat business opportunities throughout the homeownership lifecycle.

Meet the Smiths. They've just bought their first home.

BEYOND THE CLOSE

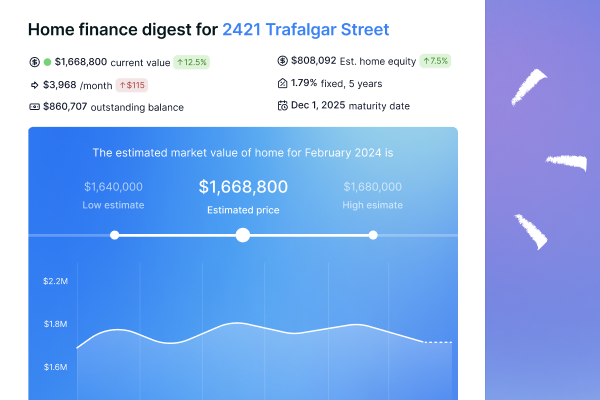

The Smiths start receiving their personalized homeownership reports from their mortgage broker.

Monthly home price estimate

Track home equity and mortgage balance

INTEREST SAVINGS

A year later, they discover they can save thousands in interest (after penalties).

Personalized interest savings analysis based on realtime refi and switch rates

Automated prepayment penalty estimates

CAPTURE RENEWALS

A few years later, the Smiths begin to think about their renewal options.

Educate clients about renewal options early

Proactively identify renewal opportunities

REFINANCE, TAP HOME EQUITY

Instead of renewing, they tap into their home equity to fund a renovation.

Up-to-date home equity calculations

Realtime rate information

NEW HOME PURCHASE

With growing equity and savings, the Smiths upgrade to a larger home in a new neighbourhood.

Advanced purchasing power calculations

One-click access to their mortgage and real estate professional for more information

🏘️🔑🎉

Turn your database into a databank.

-

Stay top of mind

Keep clients engaged with personalized homeownership reports that average 66% open rates and consistently spark mortgage conversations.

-

Uncover hidden opportunities

Ownwell automatically surfaces clients ready to save, move up or tap equity - so you know exactly who to call, and when.

-

Expand your reach

Grow your database with built-in lead gen tools and co-marketing features that put you in front of your partners’ clients too.

Expand your reach by collaborating with your referral partners.

Invite referral partners to Ownwell to offer co-branded reports to their clients.

Expand your reach by collaborating with your referral partners.

Invite referral partners to Ownwell to offer co-branded reports to their clients.

-

Reach more homeowners

Get regular visibility with your referral partners’ databases, multiplying your audience every month.

-

Stand out with partners

Offer something of value instead of just asking for referrals.

-

Strengthen relationships

Solve your partners’ client engagement problem and build deeper, longer-lasting connections.

FAQ

-

Ownwell is availably exclusively for Canadian mortgage brokers and their referral partners (realtors, financial planners, etc.).

-

Ownwell keeps you top of mind with your clients by automatically sending them a personalized monthly homeownership report. Clients read the report each month, some of them will reach out with questions, and some of these conversations turn into new deals. Each report includes valuable insights about their home and mortgage - like estimated home value, equity, and potential opportunities to save money or move up. We generate these insights by combining your client and mortgage data from your submission platform or CRM with home price estimates from one of Canada’s leading housing data providers and real-time rates from Lender Spotlight.

-

If you’re a mortgage broker with an abundance mindset and a client database of 50 or more homeowners, Ownwell is likely a great fit. The more clients you enroll, the greater your return - because each monthly report keeps you top of mind and creates natural opportunities to re-engage when clients are ready to act.

Ownwell is designed to start conversations. It gives you opportunities to demonstrate your value and expertise - even when the report includes imperfect estimates or tough news like a dip in home value. These moments aren’t problems - they’re openings for meaningful client interactions.

It’s a low-effort, high-leverage way to turn your database into repeat and referral business.

-

If you enroll at least 50 clients and follow up to ensure they’re reading and understanding their reports, you should expect to generate at least one new transaction over the course of a year.

That’s a conservative estimate. Some brokers have seen much stronger results - one broker closed 5 new deals in a single month with a database of 200 clients, while another generated 5 deals in 6 months with just 50 clients.

It’s important to remember: you can’t time when a client will need a mortgage or make a homeownership decision. If you don’t get an inquiry right away, that doesn’t mean Ownwell isn’t working. As long as your clients are reading the report, you’re generating engagement, staying top of mind, and positioning yourself to be the first call when the time is right.

Our average open rate across the platform is 60%. If your reports are being opened at a similar rate - something you can check in your dashboard - you’re on track.

The key to success is simple:

More clients enrolled = more opportunities.

More time enrolled = more chances to convert.

Stick with it, and the results will follow. -

Ownwell makes it easy to get started. You can import your client data in three ways:

Automatic Sync - We offer direct integrations with Finmo and Velocity, allowing you to seamlessly sync your client data with just a few clicks.

CSV Upload - You can upload a bulk CSV file as long as it contains the required data. Velocity users can also export a report that’s ready for upload. We also support CSV imports from BluMortgage and Filogix Expert.

Manual Entry - Want to add a few clients at a time? You can manually input client information directly in the app.

If you need help, our team is happy to guide you through the process.

-

Ownwell will automatically import up to 100 clients based on nearest mortgage maturity. If you’d like to include more, you can add client capacity anytime by purchasing additional packs of 100 clients for $50/month or $600/year.

If you have a large database and want to start with a specific group of clients, you can send us a CSV file with your selected clients - we’ll import it for you.

-

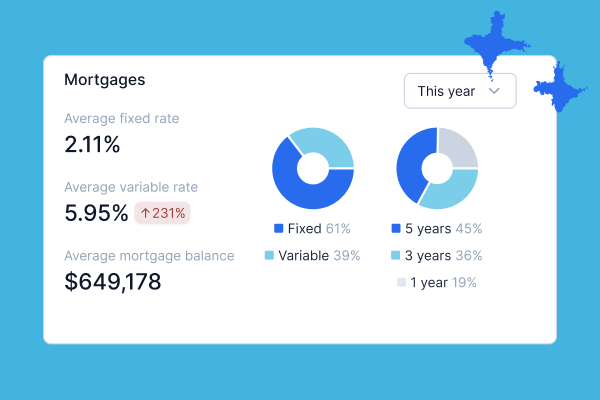

The homeowners’ digest includes a monthly home price estimate, an interest savings analysis, a purchasing power estimate, a home equity estimate, and a mortgage snapshot. Each section of the digest can be turned on or off by the broker, and no rates are visible to the client.

-

The home estimates come from one of Canada’s top housing data providers.

-

The rates are provided by Lender Spotlight.

-

Once your client data is imported, reports start going out automatically after 7 days.

The first email your clients receive is a welcome message that includes a link to their personalized homeownership report. After that, a new report is sent every month during the second week of the month.

The email is delivered by Ownwell, but it comes from you; your name appears in the “From” field, and any replies go directly to your inbox.

Reports are sent once per month, as our testing has shown that monthly delivery drives the highest engagement rates.

Clients can unsubscribe at any time (though very few do — our unsubscribe rate is under 0.5%).

-

Yes! You can offer Ownwell’s reports to referral partners’ clients and new leads with Ownwell’s new Adopt My Mortgage feature (available exclusively on Ownwell’s annual plan).

Turn your database into a 24/7 profit engine.

Ownwell pays for itself — fast. Brokers who use it see consistent, measurable results:

10% conversion of past clients into new deals within a year.

7X average ROI for brokers with 200+ clients.

Unmatched engagement: 66% open rates and 5% of clients reaching out for more info.

By rolling out Ownwell to our clients, we have generated an average of 4-5 client interactions per month to discuss their current situation, many turning into a live deal. This is the best interaction generator we have ever had.

Mike Lloyd

The Home Happy Team